Value management goes hand-in-hand with BPM, and clear and conscious attention at high level can help build the much wanted, but hard to create, “cross-functional view” of an organisation. This identifies Value Management as the point of departure if the mission is to handle in-house barriers to change.

The need to break down functional silos is widely recognized and many organisations

initiate programmes to build Business Process Management to deal with exactly that. However, the introduction of BPM is not automatically

seen as truly strategic and BPM is seldom scoped with due respect for strategic value management. This is likely to be the main reason

for many such programmes failing to deliver on the strategic expectations.

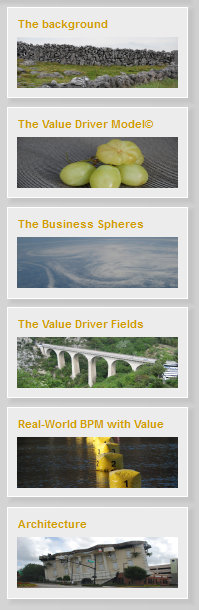

"Corporate Governance" in addition to the two Value Driver Fields “Line Management” and “Value Management” also presents the strategic “anchor” for the central “Balancing” value driver Field. The Value Driver Model© visualizes this through the area shared by all three Value Driver Fields, a triple intersection. The business aspects reflected by this intersection should not be ignored. This "strategic" triple-intersection is a vital element of "Corporate Governance" and to handle it properly is essential for maximum value to be achieved.

This triple-intersection at a strategic level tells

us that, according to the Value Driver Model©, none of the three views on value creation should be seen in isolation but must be handled

together. The better this is understood, the better the chances for success. At End-to-End we believe these concerns can be handled

through a well-organized portfolio management capability, e.g. as defined in the MoP (Management of Portfolio) methodology by the

British government.

Where the Value Driver Model© makes a difference, is by clarifying that Corporate Portfolio Management, as a inherent

part of the Business Sphere "Corporate Governance", can deliver highest value only if a strategic ownership of Value Management

is accepted and the necessity to make BPM a strategic discipline is understood.

The sphere “Corporate Governance” represents the strategic layer in a company wherein strategies and plans are continuously developed and managed.

In itself, the identification of a “Corporate Governance” sphere may seem not to present any new revolutionary thinking. However, the Value Driver Model© modifies the understanding when highlighting the shared Value Driver Field between “Corporate Governance” and the two other business spheres “Core Business” and “Business Process Management”.

Again, “Line Management” may not come as a surprise but the Value Driver Field “Value Management” shared with Business “Process Management” is not typically something that gets the same attention as ordinary line management.

However, the logic of the Value Driver Model© implies that the issue of value creation must

be on the strategic agenda, just as importantly as is line management.